- #QUICKBOOKS SELF EMPLOYED BUDGET MAC OS#

- #QUICKBOOKS SELF EMPLOYED BUDGET UPGRADE#

- #QUICKBOOKS SELF EMPLOYED BUDGET FULL#

- #QUICKBOOKS SELF EMPLOYED BUDGET SOFTWARE#

- #QUICKBOOKS SELF EMPLOYED BUDGET FREE#

#QUICKBOOKS SELF EMPLOYED BUDGET SOFTWARE#

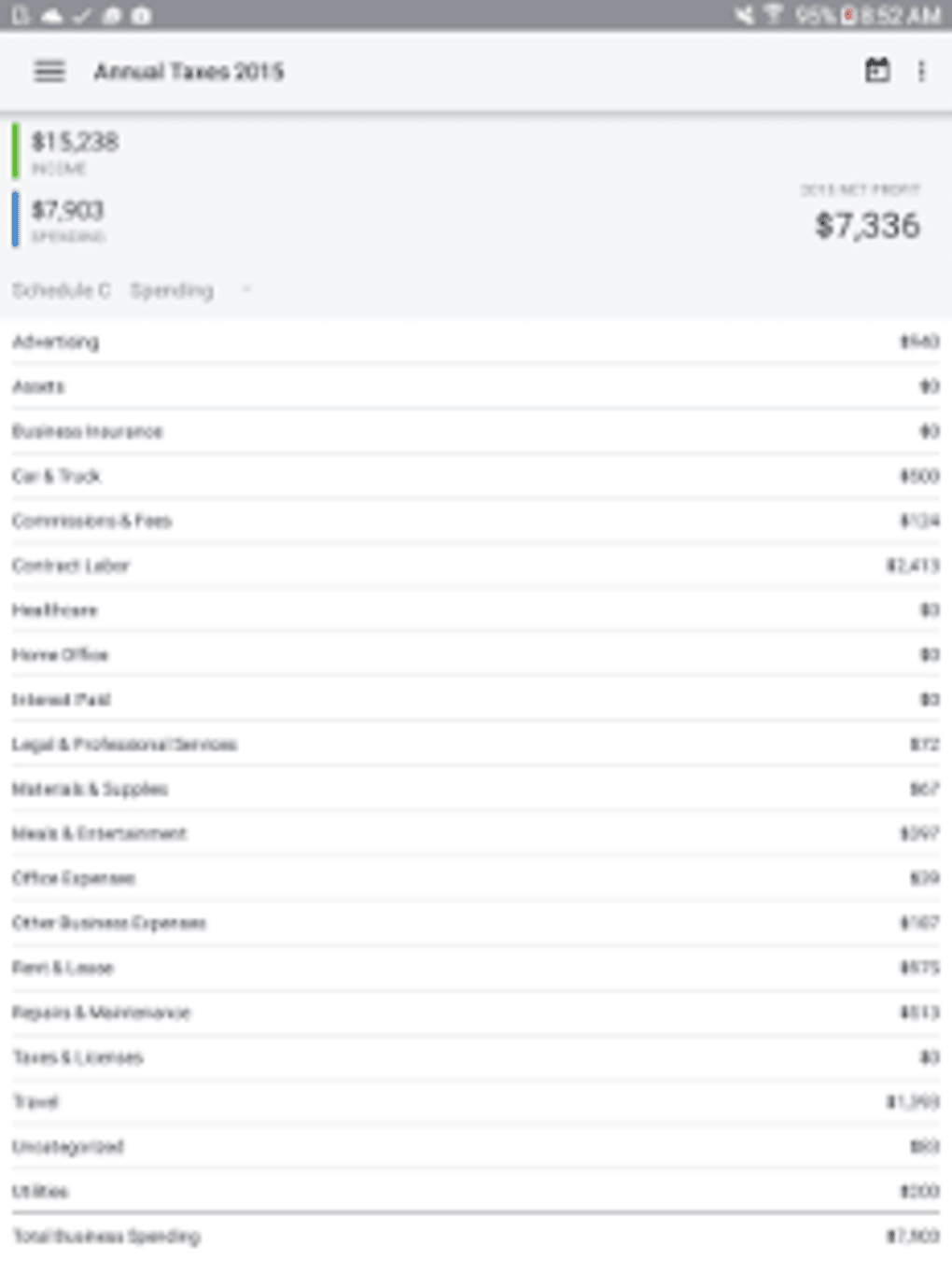

We even consider it the best for tracking freelance income and filing tax returns in our guide to the best accounting software for freelancers. QuickBooks Online Self-Employed works very well for people who work for themselves in a service industry and report their business income on Schedule C of their personal income tax return. QuickBooks Online Plans Comparison: Pricing & Features QuickBooks Online Advanced: Best for small and midsize businesses (SMBs) wanting more detailed reporting, custom user permissions, a dedicated support manager, and access for up to 25 users.

QuickBooks Online Plus: Best for retailers, wholesalers, contractors, and other small businesses requiring inventory tracking, job costing, budgeting, and access for up to five users.QuickBooks Online Essentials: Best for small businesses needing to assign hours worked to customers, track bills due, and provide access for up to three users.QuickBooks Online Simple Start: Best for small service businesses that have employees and issue invoices regularly.QuickBooks Online Self-Employed: Best for small service business owners reporting business income on Schedule C of their personal tax return, have no employees, and only issue a few invoices per week.

#QUICKBOOKS SELF EMPLOYED BUDGET UPGRADE#

Self-Employed is great if you have no employees, but you may need to upgrade to the other versions if you want more features, such as bill management, inventory tracking, and detailed reporting: Pricing runs from $15 to $200 per month, and subscription levels vary in the number of users and features included and are built for different purposes. Keeper automatically finds write offs among bank statements for self-employed people - Real estate agents, Freelancers, Rideshare Drivers, Consultants, and more.QuickBooks Online has five versions: Self-Employed, Simple Start, Essentials, Plus, and Advanced. Business runs better with QuickBooks, the #1 accounting solution for small business.

#QUICKBOOKS SELF EMPLOYED BUDGET MAC OS#

A personal and small-business financial-accounting software, licensed under GNU/GPL and available for Linux, Windows, Mac OS X, BSD, and Solaris. The #1-rated mileage and expense tracking app Personal home budget software built with Four Simple Rules to help you quickly gain control of your money, get out of debt, and reach your financial goals! View more What are some alternatives? When comparing Mint and QuickBooks Self-Employed, you can also consider the following products Quickbooks is owned by the same company as Turbotax. It will help you keep track of your expenses and then categorize them for your taxes. Quickbooks self employed is a good one (). I highly suggest getting some sort of book keeping software. So take whatever I say with a grain of salt. I am not an accountant, just a shop owner that has done my own taxes for years. It's a comparable fee if someone pays with a credit card, and no fee if someone pays via ACH. I use it for receipts, mileage, and billing. I use Quickbooks self-employed, which is cheaper than regular Quickbooks. I think QB still offers Etsy users a discount. Godaddy bookkeeping shutting down😳 what bookkeeping tool are you using for your Etsy Shop? If you want an exact answer get quick books self employed. I know you want an exact answer but there's too many unknown variables that your asking of randos on the internet. Quickbooks Self-Employed is super handy and only $15 a month. How do you guys do contracts and invoices? If I were you, I would simply start using a budgeting app - Mint, YNAB, etc. Https:/// does it automatically.īeyond this obvious overspend, like others said, you need to create a budget. How often do you track your TFSA, RRSP, or net worth extra? Daily, weekly, monthly, quarterly, yearly? The nice thing about all these is that you can connect to all your other institutions so you don't have to manually enter your transactions.

#QUICKBOOKS SELF EMPLOYED BUDGET FULL#

I use Fidelity Full View, but my bank, Needham Bank, also has a similar feature. Many banks and brokerages offer similar features. MS Money 2005 - I wish i could still use it There's lots of great tools there to help you better manage your finances.

#QUICKBOOKS SELF EMPLOYED BUDGET FREE#

Mint is a free website and app that is extremely helpful for this. Honestly, the best way to help yourself in this situation (outside of more income) is to have a budget and to track your spending every day or at least every week. If he's making purchases with cash then tracking all of them would be difficult and impractical, credit/debit card statements would have some.Īh, I see. Bringing your own coffee from home (coffee machine or instant coffee packets/powder) and/or snacks/beverages can add up to significantly reduced spending over time. Sounds like he must be frequently stopping by the vending machine for snacks/beverages or the coffee shop.

0 kommentar(er)

0 kommentar(er)